Tax Expenditures Are Part of the Budget

|

Tax Expenditures (credits, deductions, special rates, deferrals

and exclusions) are the worst part of the budget.

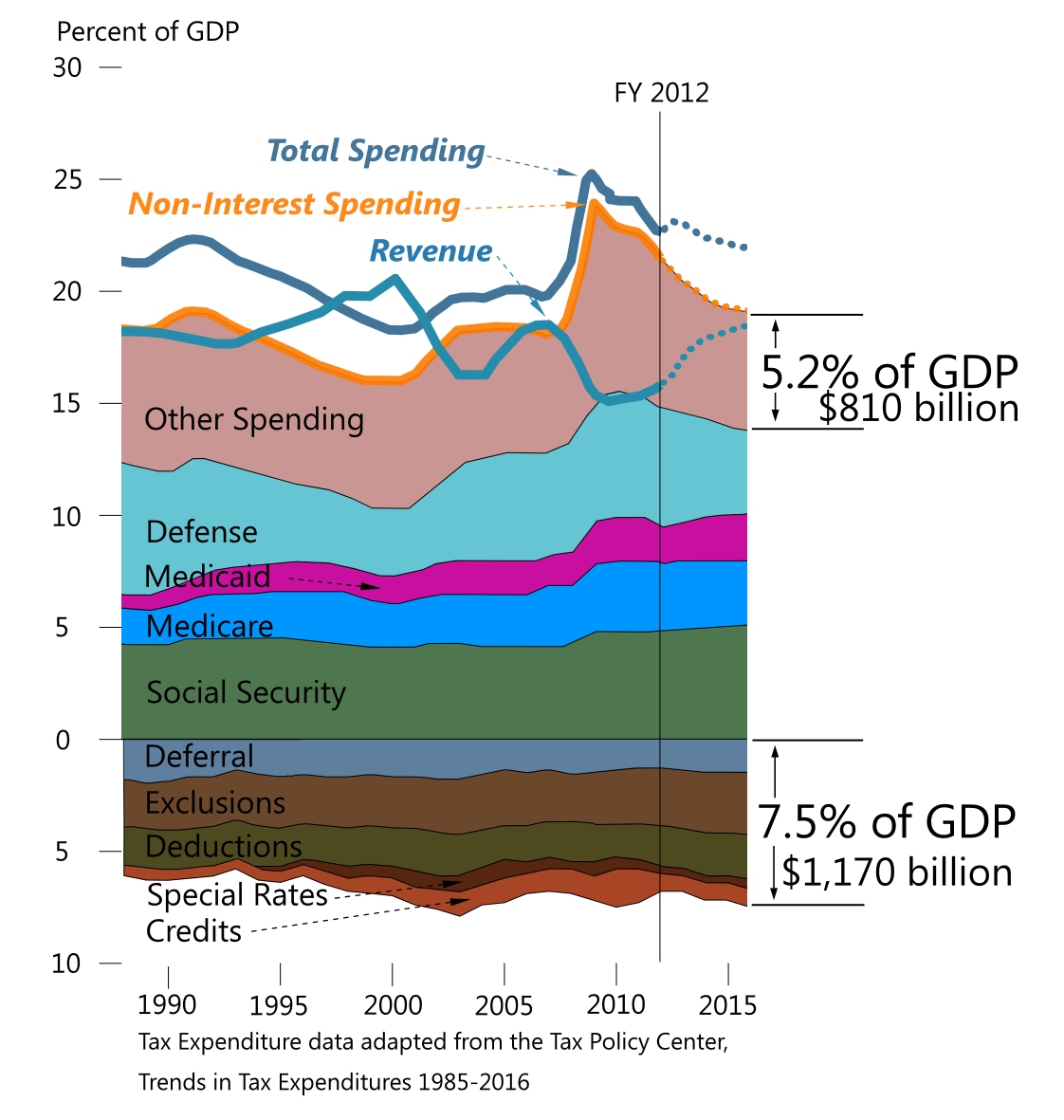

The chart at left combines the U.S. Treasury's projections through

2016 with

tax expenditure spending estimates for the same time frame prepared by the

Tax Policy Center.

In the short term the projections show revenue going up and spending

going down. This suggests that budget and tax reform may not be quite as

urgent as some in the "fix the debt" crowd have suggested. There is time to make sure that the economy recovers

from the Great Recession and the unemployment

rate comes down before finalizing consensus on much needed, "once in a generation"

tax reform. A growing number of advocates want tax reform that will reverse the

long term decline of the poor and middle class. |

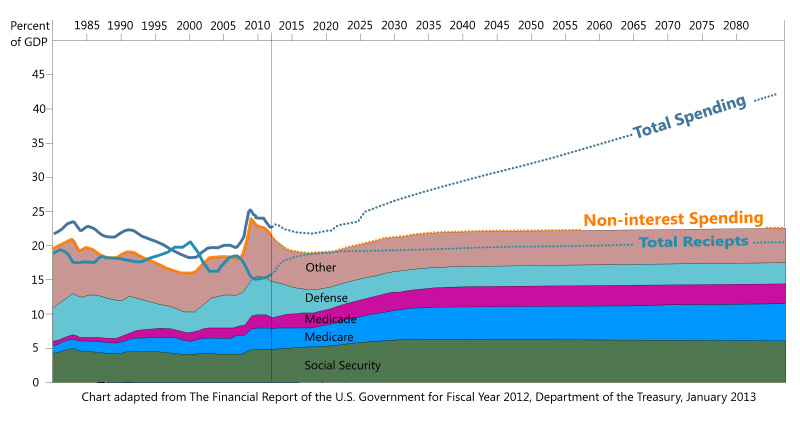

The

Financial Report of the U. S. Government for Fiscal Year 2012

prepared by the Department of the Treasury provided a long term look at the

government's financial condition. The report concludes:

The Government took potentially significant steps

towards fiscal sustainability by enacting: (1) the ACA in 2010 and (2) the

BCA in 2011. The ACA holds the prospect of lowering the long-term per

beneficiary spending growth for Medicare and Medicaid, and the BCA

significantly curtails discretionary spending. Together, these two laws

substantially reduce the estimated long-term fiscal gap. But even with these

new laws, the Government's debt-to-GDP ratio is projected to increase

continuously over the next 75 years and beyond if current policy is kept in

place, which implies that current policy is not sustainable. Subject to the

important caveat that changes in policy not be so abrupt that they slow the

economy’s recovery, the sooner policies are put in place to avert these

trends, the smaller the revenue increases and/or spending decreases will

need to be to return the Government to a sustainable fiscal path.

The introduction to the Financial Report contains "Chart 5: History and

Current Policy Projections for Receipts, Non-Interest Spending and Total

Spending" which has been adapted and reprinted below.

The projected cumulative

deficits will cause spending for interest (on the mounting debt) to escalate

at an alarming rate. The debt to GDP ratio was, "73 percent at the end of

fiscal year 2012 and under current policy is projected to be 78 percent

in 2022, 145 percent in 2042, and 395 percent in 2087," according to the

report.

Treasury suggests that fiscal prudence requires an almost immediate

increase of the average primary surplus to 2.7% of GDP between 2013 and

2087. This translates to a combination of tax increases and spending cuts of

about $420 billion a year in present dollars. The President and Congress

have been generally considering reforms which are a fraction of this amount.

If nothing is done about the deficit until

2023, an average surplus of 3.2% of GDP will be needed; and if congress waits

until 2033 to fix the problem, an average surplus of 4.1% of GDP will be needed.

|